Perhaps today more than ever, local public officials find themselves dealing with seemingly no-win, “damned if you do, damned if you don’t” decisions: Should we reopen schools? Should masks be mandated? Should we restructure the funding and mission of our policing agency? To manage for these and other issues, local public entities regularly weigh the benefits of their actions (or inaction) against community norms, perspectives and acceptance of change.

A similar evaluation about taking action exists for pools with regard to how and whether a pool should influence decisions made by its public entity members.

Pools offer coverage and risk management advice grounded in loss data and risk analysis, acting as extensions of and partners with member entities. Pools typically preserve local decision-making discretion whenever possible, trying not to act (as one pool has put it) like an “uber-board” asserting pressure on choices better left to local control.

That said, the risk advice and coverage terms pools assert unavoidably influence member entity decisions and outcomes. The danger here is that asserting the wrong amount (or kind) of influence might create a disconnect in the perceived importance of any given risk area. It might also be perceived as a pool putting its own judgment ahead of that of its members.

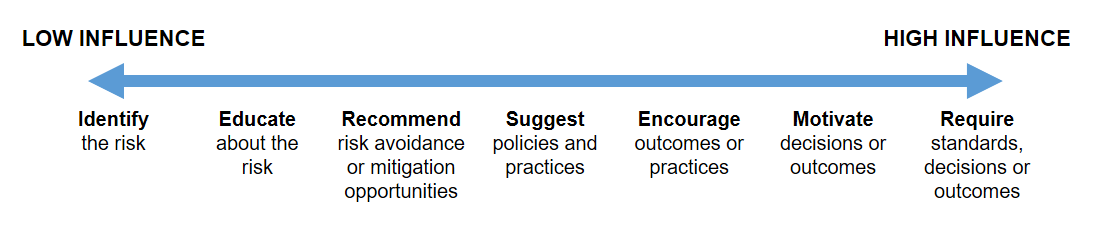

It might help to think of a pool’s methods of influencing members as options on a spectrum:

When a pool focuses its influence toward the “low influence” end of the spectrum, it might be because – while the risk issue is important – claims are not likely to be particularly significant overall. Your pool probably uses low degrees of influence to manage low-severity risk issues (even if they present frequently).

For example, a pool might identify guidelines for personnel policies or provide training about safe handling of hazardous materials but leave its members to determine and implement their own practices. Maybe a pool offers a hotline service so members seeking answers or advice have easy access to consultative resources.

Pools that heavily factor loss experience into calculating member contributions may tend to use lower degrees of influence. The extent to which a member’s own loss experience influences its contributions is a built-in financial influence that is compelling, effective and fair. Using loss experience factors alongside helpful information and recommended practices is enough influence for effectively managing many member risks.

On the “high influence” end of the spectrum are options a pool might use in case of a risk issue that is so frequent or severe that it is critical both to individual members and the pool as a whole. When a pool offers financial incentives in addition to loss experience factors, or conditions coverage on meeting risk management standards, it is asserting high degrees of influence.

For instance, a pool might offer grant programs for purchase of safety equipment. A pool might structure employment liability deductibles that change depending upon whether a member entity seeks pool input before making a termination decision. Perhaps coverage for certain risks is only offered upon a member entity successfully implementing cybersecurity protocols, land use training for elected officials, or physical inspection of high-risk properties.

Sometimes the question of how a pool influences member outcomes is colloquially described as using a “carrot” or a “stick.” The question of how best to incentivize members – whether with rewards or forfeits – is certainly a good one. But, really, the “carrot or stick” question only arises at the right end of the spectrum (encourage, motivate or require).

What degree and method of influence should your pool use? Like in so many other elements of pooling, there’s no single right answer – the influence most appropriate largely depends on the nature of your pool’s membership and the risk in question.

As you examine the degrees and methods of influence at your disposal, weigh each member’s unique need for autonomy against the interests of the whole of your pool. Other factors to consider include economic dynamics, litigation trends, and potential media, legislative and public scrutiny. By regularly evaluating these factors (alongside the no-win decisions your member entities are faced with), you can determine the best approach to influence member outcomes for any given risk issue.

--

Aug. 12, 2020 Pooling Perspective - Ann Gergen is AGRiP’s executive director and a former pool administrator. She has worked closely with and for pools, public entities, reinsurers and related service providers throughout her career.

#PoolingPerspectives#Poolingperspectives